Explore Caribbean

Jurisdictions in Caribbean (20)

The Caribbean region has long been associated with offshore finance, but the modern Caribbean business landscape offers far more than traditional tax planning structures. Today's Caribbean jurisdictions combine favorable regulatory environments with increasing substance requirements, creating opportunities for legitimate businesses seeking tax efficiency alongside operational presence in the Americas.

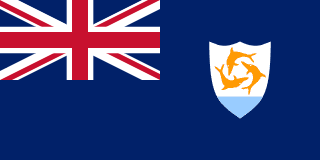

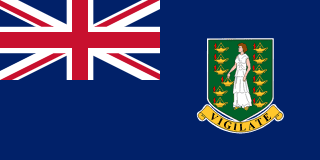

The British Virgin Islands remains the world's leading jurisdiction for international business companies, with hundreds of thousands of entities incorporated under its flexible corporate legislation. The BVI's neutral tax regime, minimal reporting requirements, and English common law framework continue to attract holding companies, investment vehicles, and trading operations. Recent economic substance legislation has modernized the jurisdiction while maintaining its competitive advantages.

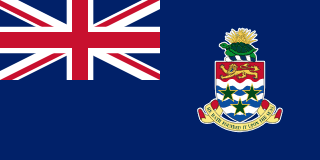

The Cayman Islands has established itself as the domicile of choice for investment funds, particularly hedge funds and private equity vehicles. Its combination of no direct taxation, sophisticated legal framework based on English common law, and proximity to the United States makes it ideal for fund structures serving North American investors. The jurisdiction's insurance and banking sectors also represent significant industries beyond fund administration.

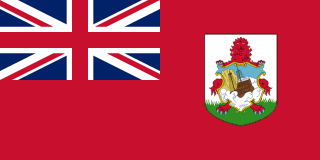

Bermuda offers a unique value proposition as a leading domicile for insurance and reinsurance companies, combining tax neutrality with a highly developed regulatory framework. The island's close ties to both London and New York financial markets and its expertise in specialty insurance lines have created a thriving industry cluster.

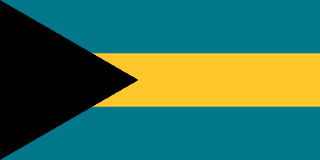

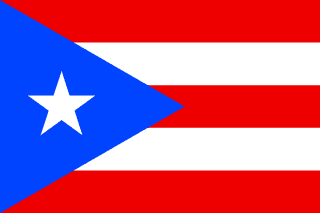

Jurisdictions like Barbados, the Bahamas, and Puerto Rico have developed their own niches, from intellectual property holding structures to incentive programs for high-net-worth individuals. Puerto Rico's unique status as a US territory with its own tax system has created interesting planning opportunities for American citizens and businesses.

The Caribbean's evolution toward greater transparency and substance requirements reflects broader global trends in international taxation. Businesses establishing in the region today must carefully consider substance requirements, beneficial ownership reporting, and the reputation implications of their chosen jurisdiction. The most successful Caribbean structures combine tax efficiency with genuine operational presence and commercial rationale.