Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

Premier offshore financial center for funds and holding companies

Region

CARIBBEAN

Corporate Tax

0%

Setup Time

2 weeks

Currency

KYD

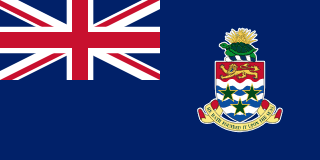

The Cayman Islands, a British Overseas Territory in the Caribbean, has developed into one of the world's leading financial centers. The jurisdiction's sophisticated regulatory environment and tax neutrality support premium company registration and business setup for investment funds, insurance, and corporate structures.

With a population of 70,000 across three islands, the Cayman Islands offer prosperous Caribbean living. English is the official language. Grand Cayman provides excellent infrastructure, dining, and amenities. The tropical climate is pleasant year-round, with hurricane risk during summer months.

Healthcare is good, with Health City Cayman Islands providing advanced care and the Cayman Islands Hospital handling general needs. Safety is excellent with very low crime rates. The cost of living is extremely high, particularly for housing, reflecting the affluent population.

The international community is substantial, creating a cosmopolitan atmosphere despite the small population.

The Cayman Islands have no direct taxes—no corporate tax, income tax, capital gains tax, or withholding tax. Revenue comes from import duties, work permit fees, and financial services licensing fees. This tax neutrality, combined with regulatory sophistication, attracts global financial services.

The Cayman Islands dollar is pegged to the US dollar at approximately 1.2:1. The Cayman Islands Monetary Authority (CIMA) provides world-class regulation, particularly for investment funds. The jurisdiction maintains international standards for AML and tax transparency.

Company registration through the General Registry offers various structures. Exempted companies serve international business, requiring minimum one shareholder and one director. The legal framework, based on English law, is well-developed and predictable.

Company formation completes within 24-48 hours for standard structures. No minimum capital requirements apply to exempted companies. Annual fees and compliance requirements apply. Regulated activities require CIMA licensing.

CIMA regulates virtual asset service providers under the Virtual Asset (Service Providers) Act. The crypto license framework covers exchanges, custodians, and other digital asset businesses. The regulatory approach emphasizes compliance and governance appropriate for institutional-grade operations.

The Cayman Islands have attracted significant digital asset businesses seeking regulated status in a respected jurisdiction.

The Cayman Islands do not license gambling operations. The jurisdiction has not positioned itself for gaming services. Entrepreneurs seeking gambling license frameworks must look to other jurisdictions.

The premium cost structure—including licensing fees, professional services, and operating costs—makes the Cayman Islands suitable only for substantial financial services operations. The jurisdiction is not cost-competitive for general commercial operations.

Banking access is excellent for legitimate financial services. Professional services are world-class but priced accordingly. The regulatory requirements are substantial, ensuring quality but requiring investment in compliance.

The Cayman Islands suit investment funds, insurance captives, structured finance vehicles, and institutions seeking premier regulatory status for their business setup.

Local: LLC

Local: Exempt Company

Local: Foundation

Local: Trust

Local: LP

| Corporate Tax Rate | 0% |

| Personal Income Tax Rate | 0% |

| VAT / Sales Tax | 0% |

| Capital Gains Tax | 0% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | No |

| Non-Resident Withholding Exempt | Yes |

| Tax Treaty Network | No |

| Banking Access | HIGH |

| Financial Privacy | HIGH |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | No |

| Banks Restrictive (High Risk) | No |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | No |

| Mandatory Audit | No |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | No |

| Required Share Capital | $100,000 |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF Travel Rule |

| Business Plan Required | Detailed business plan with operational strategy, risk management framework, and financial projections required |

| Personnel Required | Local AML Officer required, CIMA-approved director for custodial services, minimum 3 directors for licensed VASPs |

| Insurance Required | No |

| Remote Incorporation Possible | Yes |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 3 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | CIMA maintains public register of VASP licensees and registered persons |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | No |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Cayman Islands Monetary Authority (CIMA) |

| Licensing Fee | $1,220 |

| Licensing Fee Details | Application fee KYD 1,000 (USD 1,220). Annual fees range from KYD 5,000 to KYD 200,000 depending on service type. VASP registration fees from KYD 1,500 to KYD 15,000. Full license fees for custody/trading platforms significantly higher. |

| Permitted Business Models | Exchange, Custody, Trading Platform, Virtual Asset Issuance |

| Permitted Activities | Crypto-to-fiat exchange, crypto-to-crypto exchange, virtual asset transfers, custody services, trading platform operation, virtual asset issuance |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | No |

| Derivatives Allowed | Yes |

| RWA Tokenization Allowed | Yes |

| App Store Listing Allowed | Yes |

| Crypto Custody Allowed | Yes |

Commercial gambling is prohibited under the Gambling Law (2016 Revision). Only charitable raffles are permitted under license from the Cabinet. A non-binding referendum in April 2025 approved introduction of a national lottery, which is under review by the Law Reform Commission, but no licensing framework exists as of January 2026.

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $36,600 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant |

| Business Plan Required | Detailed business plan required including operational strategy and risk management |

| Personnel Required | Officers and directors subject to fit and proper assessment by CIMA |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | CIMA maintains public register of licensed entities |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Cayman Islands Monetary Authority (CIMA) |

| Licensing Fee | $4,880 |

| Licensing Fee Details | Money Services Business: Minimum net worth KYD 30,000 (USD 36,600) required, application fee approximately KYD 4,000. Banking license: Unrestricted license requires minimum paid-up capital of KYD 400,000 (USD 488,000), restricted license KYD 20,000 (USD 24,400). Annual fees vary by license type and asset size. |

| Permitted Business Models | Money Services Business, Banking (Class A and B), Trust Company, Company Management |

| Permitted Activities | Money transmission, currency exchange, payment services, banking services, trust administration, company management |

| Restricted Activities | Banking without appropriate Class A or B license |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |