Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

Leading offshore jurisdiction with no corporate taxes

Region

CARIBBEAN

Corporate Tax

0%

Setup Time

1 weeks

Currency

USD

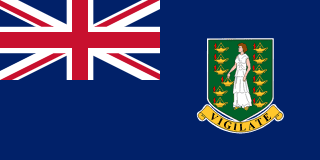

The British Virgin Islands (BVI), a British Overseas Territory in the Caribbean, has maintained its position as one of the world's leading offshore jurisdictions. Company registration here offers established frameworks for business setup, though increased transparency requirements have modernized the traditional offshore model.

With a population of 30,000 across approximately 50 islands, the BVI offers intimate Caribbean living. English is the official language. The islands provide beautiful beaches and excellent sailing in a tropical climate. Tortola, the main island, hosts most amenities and services.

Healthcare is limited, with Peebles Hospital providing basic care. Serious cases require evacuation, typically to Puerto Rico. The cost of living is very high, driven by import dependence and limited local production. Safety is generally good with low crime rates.

Hurricane vulnerability is significant, as demonstrated by Hurricane Irma's 2017 devastation.

BVI Business Companies face no corporate income tax, capital gains tax, or inheritance tax. There is no VAT. Government revenue comes primarily from company registration fees and work permits. This tax-neutral status, combined with corporate law flexibility, has made the BVI a preferred incorporation jurisdiction.

The US dollar is the official currency. The Financial Services Commission provides regulatory oversight. The BVI has adopted beneficial ownership reporting requirements and participates in international tax information exchange, representing significant transparency evolution.

Company registration through the Registry of Corporate Affairs is efficient. BVI Business Companies (BC) replaced the former IBC structure. A BC requires minimum one shareholder and one director, who may be the same person. Corporate directors are permitted.

Company formation completes within 24-48 hours typically. No minimum capital requirement applies. Annual fees and registered agent maintenance are required. Bearer shares are no longer available. Beneficial ownership information must be reported to the Financial Services Commission.

The BVI has not established a specific crypto license regime. Digital asset businesses can incorporate BCs for holding and operational purposes but will need licensing from other jurisdictions for regulated activities.

The jurisdiction monitors developments while focusing on its traditional strengths in corporate structuring rather than regulated financial services.

The BVI does not offer gambling licenses and does not position itself for gaming operations. Entrepreneurs seeking gambling license frameworks look to other Caribbean jurisdictions with established gaming regulation.

Despite transparency improvements, some banking and service providers remain cautious about BVI structures. Due diligence requirements have increased. The jurisdiction's reputation, while evolved, carries historical offshore associations.

Professional services are well-developed for corporate structuring but concentrated among several major providers. Physical presence on the islands is expensive and operationally challenging.

The BVI suits holding company structures, investment vehicles, and businesses seeking proven corporate law frameworks with tax neutrality for their business setup.

Local: LLC

Local: BVI BC

Local: Trust

| Corporate Tax Rate | 0% |

| Personal Income Tax Rate | 0% |

| VAT / Sales Tax | 0% |

| Capital Gains Tax | 0% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | No |

| Non-Resident Withholding Exempt | Yes |

| Tax Treaty Network | No |

| Banking Access | LOW |

| Financial Privacy | MEDIUM |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | No |

| Banks Restrictive (High Risk) | Yes |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | No |

| Mandatory Audit | No |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | No |

| Required Share Capital | $0 |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF Travel Rule |

| Business Plan Required | Comprehensive business plan required including operations, risk management strategies, compliance procedures, business model, outsourcing arrangements, and risk assessment |

| Personnel Required | Two or more directors meeting fit and proper criteria, Authorized Representative (physical BVI resident or BVI business), Money Laundering Reporting Officer (MLRO), qualified auditor |

| Insurance Required | No |

| Remote Incorporation Possible | Yes |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 2 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | FSC maintains list of registered VASPs; limited information publicly available |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | BVI Financial Services Commission (FSC) |

| Licensing Fee | $5,000 |

| Licensing Fee Details | $5,000 application fee for general VASP registration; $10,000 for virtual assets exchange or custody services. Additional fees: $200 for senior officer/director approval, $1,000 for auditor application, $1,500 for auditor appointment approval, $2,000 for authorized representative approval |

| Permitted Business Models | Virtual asset exchange, Custody services, Virtual asset transfer services, Financial services for token issuance |

| Permitted Activities | Exchange between virtual assets, Exchange between virtual assets and fiat currency, Virtual asset transfers, Custody and safekeeping of virtual assets, Participation in financial services for virtual asset issuance |

| Restricted Activities | Proprietary token issuance without additional VASP registration if providing services for others; activities falling under SIBA or FMSA may require additional licensing |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | No |

| Derivatives Allowed | No |

| RWA Tokenization Allowed | Yes |

| App Store Listing Allowed | Yes |

| Crypto Custody Allowed | Yes |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | No |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | N/A |

| Business Plan Required | Detailed business plan and financial disclosures required |

| Personnel Required | Background checks required for directors and key personnel |

| Insurance Required | No |

| Remote Incorporation Possible | Yes |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | Gaming and Betting Control Commission maintains licensing records |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | Gambling (Gaming and Betting) Control Commission |

| Licensing Fee Details | Licensing fee structure not yet publicly disclosed; Gaming and Betting Control Act 2020 framework with regulations still being developed as of 2025 |

| Permitted Business Models | B2C, B2B, Land-based gaming, Online gaming |

| Permitted Activities | Casino gaming, Sports betting, Gaming machine operations, Gaming software manufacturing and distribution |

| Restricted Activities | The Gaming and Betting Control Commission determines permitted activities; certain activities may require specific license categories |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |

| Player Fund Segregation | Yes |

| B2B/B2C Separate Requirements | Yes |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | No |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant |

| Business Plan Required | Comprehensive business plan required per Regulatory Code sections 11 and 12, including corporate governance details, organizational structure, and operational plans |

| Personnel Required | Resident directors (for some categories), senior officers, compliance officer, Money Laundering Reporting Officer (MLRO), solicitor |

| Insurance Required | Yes |

| Insurance Details | Professional indemnity and other insurance as prescribed by FSC |

| Remote Incorporation Possible | Yes |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | FSC maintains public register of licensed financial services providers at bvifsc.vg |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | BVI Financial Services Commission (FSC) |

| Licensing Fee Details | Fees vary by license class under FMSA and SIBA; application fees, annual license fees and renewal fees apply per FSC Fees Regulations. Class A money services license available; Class F (peer-to-peer lending) not yet in force |

| Permitted Business Models | Money transmission (Class A), Investment business, Trust services, Fund management |

| Permitted Activities | Money transmission, Electronic money, Mobile money, Payment transmission, Investment dealing, Investment advice, Fund administration |

| Restricted Activities | Banking requires separate license under Banks and Trust Companies Act; International financing and lending (Class F) provisions not yet in force |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |