Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

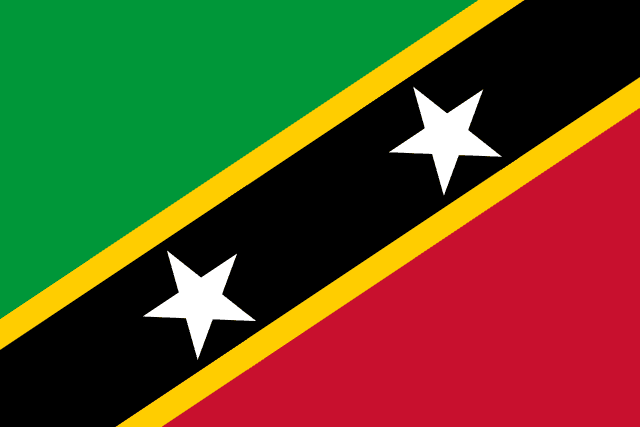

Caribbean nation with citizenship by investment program

Region

CARIBBEAN

Corporate Tax

25%

Setup Time

2 weeks

Currency

XCD

St. Kitts and Nevis, the smallest sovereign state in the Western Hemisphere, has established itself as a premier offshore financial center and home to the world's oldest Citizenship by Investment program. This twin-island federation combines tax efficiency, strong privacy protections, and second citizenship opportunities in a stable political environment.

With a population of approximately 55,000 people, St. Kitts and Nevis offers an intimate island lifestyle with modern amenities. English is the official language, and the islands maintain a British Commonwealth heritage with parliamentary democracy. The tropical climate provides warm temperatures year-round, though hurricane season (June-November) requires planning.

Healthcare facilities include JNF General Hospital in Basseterre and Alexandra Hospital in Nevis, with medical evacuations to larger regional centers for complex procedures. The cost of living is moderate by Caribbean standards, with imported goods commanding premium prices. The islands feature excellent beaches, golf courses, and a growing tourism infrastructure.

Real estate options range from beachfront villas to hillside estates, with strong property rights protections. The crime rate is relatively low, making it a safe destination for families and retirees seeking Caribbean living.

The federation operates a territorial tax system where offshore companies conducting business entirely outside the islands pay 0% corporate tax. Domestic companies face a 25% corporate tax rate. There is no capital gains tax, no inheritance tax, and no withholding tax on dividends paid to non-residents.

The Eastern Caribbean Dollar (XCD), pegged to the US Dollar at 2.70:1, provides currency stability. No exchange controls restrict capital movement. The islands are members of CARICOM and the OECS, providing regional trade benefits.

The regulatory environment balances business-friendly policies with international compliance standards. The Financial Services Regulatory Commission (FSRC) oversees financial services with a reputation for professionalism.

International Business Companies (IBCs) can be incorporated within 48 hours through the Nevis Business Corporation Ordinance. Key features include:

Annual requirements include maintaining a registered agent in Nevis and paying government fees. No annual filing of financial statements is required for standard IBCs.

The FSRC regulates Virtual Asset Service Providers (VASPs) under an established framework. Crypto businesses can obtain licenses for exchange, custody, transfer, and related financial services. Key requirements:

The framework permits fiat-crypto exchange, crypto-crypto trading, custody services, and token issuance.

The Nevis Online Gaming Authority (NOGA), established April 2025 under the Nevis Online Gaming Ordinance 2025, provides a modern regulatory framework for online gambling. License fees are EUR 28,000 annually for B2C or B2B operations.

Permitted activities include online casino, sports betting, poker, esports, and fantasy sports. Restricted markets include USA, UK, France, Germany, Austria, Spain, Australia, Netherlands, and local residents.

St. Kitts and Nevis operates the world's oldest Citizenship by Investment program, established in 1984. The program offers two primary pathways:

Sustainable Island State Contribution (SISC): Starting at USD 250,000 for a single applicant (increased from USD 150,000 in 2023). Family applications available with additional fees per dependent.

Real Estate Investment: Minimum USD 400,000 in approved real estate developments, held for a minimum of 7 years. Alternatively, USD 200,000 in shared ownership arrangements.

Processing typically takes 3-6 months with accelerated options available. Due diligence is conducted through authorized agents with thorough background checks.

St. Kitts and Nevis citizenship provides visa-free or visa-on-arrival access to over 155 countries, including the UK, EU Schengen area, Hong Kong, Singapore, and most Commonwealth nations. Citizens can also apply for 10-year US B1/B2 visas.

The program underwent significant reforms in 2023-2024, including enhanced due diligence, elimination of citizenship by birth for children of CBI parents born outside the islands, and increased investment thresholds. The government actively maintains the program's integrity and international standing.

Banking access can be challenging for offshore structures, with regional banks applying enhanced due diligence. Some international banks may decline accounts for companies with only CBI citizen directors. Professional services are available but limited compared to larger financial centers.

Geographic isolation increases operational costs and limits direct flight connections. Internet infrastructure has improved but may not meet requirements for intensive digital operations. Hurricane exposure requires business continuity planning.

The small domestic market means businesses must focus on international operations. The jurisdiction suits entrepreneurs seeking tax-efficient structures, CBI applicants needing strong passport benefits, and gaming or crypto operators seeking a regulated Caribbean base.

Local: LLC

Local: IBC

Local: Foundation

Local: Trust

| Corporate Tax Rate | 25% |

| Personal Income Tax Rate | 10-32% |

| VAT / Sales Tax | 17% |

| Capital Gains Tax | 0% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | Yes |

| Non-Resident Withholding Exempt | No |

| Tax Treaty Network | Yes |

| Banking Access | MEDIUM |

| Financial Privacy | HIGH |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | No |

| Banks Restrictive (High Risk) | Yes |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | No |

| Mandatory Audit | No |