Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

Premier reinsurance and captive insurance domicile

Region

CARIBBEAN

Corporate Tax

0%

Setup Time

2 weeks

Currency

BMD

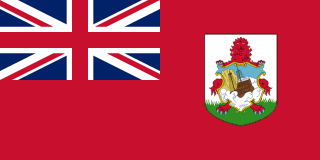

Bermuda, a British Overseas Territory in the North Atlantic, has developed a sophisticated financial services sector specializing in insurance and reinsurance. The jurisdiction's regulatory approach and proximity to the US East Coast support high-quality company registration and business setup.

With a population of 64,000, Bermuda offers an affluent island lifestyle with British influences. English is the official language. The island provides excellent beaches, golf courses, and sailing in a subtropical climate. Safety is excellent with very low crime rates.

Healthcare is good, with King Edward VII Memorial Hospital providing comprehensive services. The cost of living is among the highest globally, driven by import costs and limited housing supply. Education standards are high, with a British-influenced curriculum.

The compact island creates a close-knit community that can feel either welcoming or insular depending on integration success.

Bermuda has no corporate income tax, personal income tax, capital gains tax, or VAT. Government revenue comes from payroll tax, customs duties, and company fees. This tax-neutral status, combined with regulatory sophistication, has attracted insurance, reinsurance, and investment fund industries.

The Bermuda Monetary Authority provides world-class financial regulation, particularly for insurance. The jurisdiction's Solvency II equivalence enables EU market access for insurers. Extensive tax information exchange participation maintains international acceptability.

Company registration through the Registrar of Companies involves structured processes for different company types. Exempted companies serve non-local business and require minimum one shareholder and one director. Local companies can trade within Bermuda.

Company formation typically takes 1-2 weeks for exempted companies, longer for regulated entities. No minimum capital requirements apply to general exempted companies, though insurance companies face substantial capitalization requirements. Non-Bermudians require work permits for local employment.

Bermuda introduced the Digital Asset Business Act, creating one of the world's first comprehensive crypto license regimes. The Bermuda Monetary Authority licenses digital asset businesses across various classifications including digital asset exchanges, custodians, and token issuers.

The regulatory framework emphasizes robust compliance requirements suitable for institutional-grade operations, attracting established digital asset businesses seeking regulatory credibility for their crypto license needs.

Bermuda regulates limited casino gaming primarily for tourism purposes. Online gambling license opportunities are minimal, as the jurisdiction has not positioned itself for remote gaming operations. The focus remains on land-based, tourism-integrated gaming.

The high cost of operations—including housing, work permits, and general expenses—makes Bermuda suitable only for substantial businesses that justify premium positioning. Banking access is good through local banks serving the financial services industry.

The remote Atlantic location means longer travel connections. Work permit requirements limit staffing flexibility. Professional services are expensive but sophisticated, particularly for insurance and investment structures.

Bermuda suits insurance and reinsurance companies, investment funds, high-value holding structures, and businesses seeking regulatory excellence for their business setup.

Local: LLC

Local: Exempt Company

Local: Limited Partnership

| Corporate Tax Rate | 0% |

| Personal Income Tax Rate | 0% |

| VAT / Sales Tax | 0% |

| Capital Gains Tax | 0% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | No |

| Non-Resident Withholding Exempt | Yes |

| Tax Treaty Network | No |

| Banking Access | MEDIUM |

| Financial Privacy | MEDIUM |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | No |

| Banks Restrictive (High Risk) | Yes |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Quarterly |

| Local Bookkeeping Required | No |

| Mandatory Audit | No |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $100,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF Travel Rule compliant |

| Business Plan Required | Detailed business plan with activity mapping to DABA Section 2(2), governance charter, risk and compliance framework required |

| Personnel Required | Senior Representative resident in Bermuda, CISO, Compliance Officer, MLRO |

| Insurance Required | Yes |

| Insurance Details | Professional indemnity insurance required based on risk profile |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | BMA maintains confidential register of licensed digital asset businesses |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Bermuda Monetary Authority (BMA) |

| Licensing Fee | $2,266 |

| Licensing Fee Details | Application fee: Class T USD 1,000, Class M/F USD 2,266. Annual fee: lower of USD 450,000 or 0.075% of client receipts (minimum USD 15,000 for most services, USD 150,000 for custody) |

| Permitted Business Models | Exchange, Custody, Token Issuance, Payment Services, Broker, Stablecoin Issuer |

| Permitted Activities | Issuing/selling/redeeming digital assets, payment services using digital assets, electronic exchange operation, custodial wallet services, digital asset derivatives, lending, stablecoin issuance |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | No |

| Derivatives Allowed | Yes |

| RWA Tokenization Allowed | Yes |

| App Store Listing Allowed | Yes |

| Crypto Custody Allowed | Yes |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | N/A for gambling |

| Business Plan Required | Detailed business plan and response to RFP from Bermuda Gaming Commission required |

| Personnel Required | Key management personnel subject to suitability review |

| Insurance Required | Yes |

| Insurance Details | Required as part of license conditions |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | Bermuda Gaming Commission maintains license records |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | Yes |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Bermuda Gaming Commission (BGC) |

| Licensing Fee | $600,000 |

| Licensing Fee Details | Initial application fee BMD 600,000, provisional license fee BMD 1,400,000, full license issue fee BMD 1,000,000. Casino gaming tax 10% of gross win |

| Permitted Business Models | Integrated Resort Casino only |

| Permitted Activities | Casino gaming at designated hotel resort sites only. Maximum 3 casino licenses available |

| Restricted Activities | Online gambling not licensed under Casino Gaming Act. Standalone casinos not permitted - must be part of integrated resort |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | Yes |

| Player Fund Segregation | Yes |

| B2B/B2C Separate Requirements | No |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $10,000,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant |

| Business Plan Required | Comprehensive 3-year business plan with capital adequacy and liquidity projections |

| Personnel Required | CEO, CFO, Compliance Officer, MLRO, Board of Directors |

| Insurance Required | Yes |

| Insurance Details | Professional indemnity insurance required |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 2 |

| Shareholder/Director Same Person | No |

| Registry Public | Yes |

| Registry Access | BMA maintains public register of licensed banks and financial institutions |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Bermuda Monetary Authority (BMA) |

| Licensing Fee Details | Fees vary by license type. Banking license: significant application and annual fees based on asset size. Money Service Business and Investment Business licenses have separate fee structures published by BMA |

| Permitted Business Models | Banking, Trust Company, Investment Business, Fund Administration, Money Service Business |

| Permitted Activities | Deposit taking, lending, payment services, money transmission, currency exchange, investment management, fund administration |

| Restricted Activities | Banks must provide Core Banking Services to Bermuda residents. Proprietary trading restricted |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |