Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

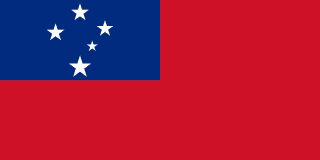

Pacific offshore with international companies

Region

OCEANIA

Corporate Tax

0%

Setup Time

2 weeks

Currency

USD

Samoa, an independent Pacific island nation, has developed international company and trust registries. The country's company registration framework supports specific offshore business setup strategies.

With a population of 220,000, Samoa offers traditional Pacific island living. Samoan and English are official languages. The tropical climate is warm and humid with cyclone risk.

Healthcare is limited, with serious cases requiring evacuation to New Zealand. Safety is excellent with minimal crime. The cost of living is moderate.

The traditional culture and natural environment appeal to those seeking authentic Pacific experience.

International companies pay no tax on foreign income. No capital gains tax, wealth tax, or inheritance tax applies to offshore structures. Domestic taxes apply to local operations.

The Samoan tala is local currency, with New Zealand dollars also circulating. The economy depends on remittances, agriculture, and tourism.

Company registration through the Registrar of International and Foreign Companies is efficient. International companies and trusts serve offshore purposes.

Company formation completes within days. No minimum capital requirements apply. Bearer shares are no longer available. Annual fees apply.

Samoa has not established crypto license frameworks. The jurisdiction has not prioritized fintech development.

Samoa does not offer gambling licensing. The jurisdiction has not developed gaming regulation.

Geographic remoteness creates significant challenges. Banking access is very difficult for Samoan structures. The professional services sector is small.

Samoa suits specific asset protection structures and those with particular Pacific requirements for their business setup.

Local: Ltd

Local: International Company

Local: Trust

| Corporate Tax Rate | 0% |

| Personal Income Tax Rate | 0% |

| VAT / Sales Tax | 15% |

| Capital Gains Tax | 0% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | No |

| Non-Resident Withholding Exempt | Yes |

| Tax Treaty Network | No |

| Banking Access | MEDIUM |

| Financial Privacy | VERY HIGH |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | No |

| Banks Restrictive (High Risk) | Yes |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | No |

| Mandatory Audit | No |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | No |

| Required Share Capital | $0 |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF guidelines apply |

| Business Plan Required | Business license and compliance with Central Bank reporting requirements |

| Personnel Required | No specific personnel requirements beyond standard compliance |

| Insurance Required | No |

| Remote Incorporation Possible | Yes |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | Not publicly accessible |

| Renewal Period | Annual |

| Accounting Filing Required | No |

| Financial Statement Required | No |

| Accounting Audit Mandatory | No |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | Central Bank of Samoa (CBS) |

| Licensing Fee | $0 |

| Licensing Fee Details | No specific VASP license fee. Standard business license required plus compliance with CBS reporting requirements for financial institutions under Money Laundering Prevention Amendment Act 2018. |

| Permitted Business Models | Exchange, custody, transfer services |

| Permitted Activities | Crypto exchange, custody, payments (subject to financial institution compliance) |

| Restricted Activities | Cryptocurrency is not legal tender. All crypto activities must comply with AML/CFT regulations. |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | No |

| Derivatives Allowed | No |

| RWA Tokenization Allowed | No |

| App Store Listing Allowed | Yes |

| Crypto Custody Allowed | Yes |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | N/A |

| Business Plan Required | Required for casino and gambling license applications |

| Personnel Required | Key management personnel subject to fit and proper requirements |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | Gambling Control Authority maintains license records |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | Yes |

| Regulators | Gambling Control Authority (GCA) |

| Licensing Fee Details | Land-based casino licenses available. Online gambling is currently unregulated - no licenses issued for online operators. |

| Permitted Business Models | B2C land-based casinos, lotteries, sports betting |

| Permitted Activities | Land-based casino games, lotteries, sports betting through licensed bookmakers |

| Restricted Activities | Online gambling is unregulated - no licensed online gambling operators in Samoa. Offshore gambling licenses not available for international operators. |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | Yes |

| Player Fund Segregation | Yes |

| B2B/B2C Separate Requirements | No |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $1,000,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant |

| Business Plan Required | Comprehensive business plan required for banking license applications |

| Personnel Required | Minimum 2 directors (1 must be resident), full-time employees, approved auditor |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 2 |

| Shareholder/Director Same Person | No |

| Registry Public | No |

| Registry Access | SIFA and Central Bank of Samoa maintain license records |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Quarterly for Class A/B1, Half-yearly for B2 |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | Samoa International Finance Authority (SIFA), Central Bank of Samoa (CBS) |

| Licensing Fee Details | International Banking Act 2005 provides three-tier licensing: Class A (USD 10,000,000 capital, unrestricted), Class B1 (USD 2,000,000 capital, restricted), Class B2 (USD 1,000,000 capital, most restricted). No specific EMI/PI license framework exists. |

| Permitted Business Models | International banking (Class A, B1, B2), trust services, insurance |

| Permitted Activities | Banking services, deposit-taking, lending, foreign exchange (with appropriate license class) |

| Restricted Activities | Domestic banking services without appropriate licensing. No dedicated EMI/PI licensing framework. |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |