Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

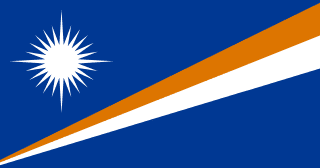

Pacific offshore for shipping and holding companies

Region

OCEANIA

Corporate Tax

0%

Setup Time

2 weeks

Currency

USD

The Marshall Islands, a Pacific island nation, has developed a significant ship registry and corporate registration system. The jurisdiction's streamlined company registration supports specific business setup strategies, particularly for maritime operations.

With a population of 42,000 spread across atolls, the Marshall Islands offer remote Pacific living. English and Marshallese are official languages. The tropical climate is warm year-round with typhoon risk.

Healthcare is limited, with serious cases requiring evacuation. The cost of living is moderate but supply-dependent. Infrastructure is basic outside Majuro.

Few choose the Marshall Islands for lifestyle; it serves primarily as legal domicile.

Non-resident domestic corporations and LLCs pay no income tax on foreign-sourced income. There is no capital gains tax or withholding tax for qualifying entities. The tax-neutral status attracts ship registration and holding structures.

The US dollar is official currency. The economy depends on US Compact of Free Association payments and the corporate registry.

Company registration through the Trust Company of the Marshall Islands is efficient. Corporations and LLCs serve different purposes. The ship registry is among the world's largest.

Company formation completes within 24-48 hours. No minimum capital requirements apply. Bearer shares are no longer permitted. Annual fees and registered agent maintenance apply.

The Marshall Islands has shown interest in digital assets, including a proposed sovereign cryptocurrency (SOV). However, comprehensive crypto license frameworks for third-party businesses are not established.

The Marshall Islands does not offer gambling licensing. The jurisdiction has not developed gaming regulation.

Geographic remoteness creates challenges for any physical operations. Banking access can be difficult for Marshall Islands entities. The jurisdiction's primary value is for ship registration and specific holding purposes.

Professional services are provided through the registry system rather than extensive local options.

The Marshall Islands suits ship registration, aircraft registration, and specific holding structures for their business setup.

Local: LLC

Local: IBC

Local: Trust

Local: LP

| Corporate Tax Rate | 0% |

| Personal Income Tax Rate | 0% |

| VAT / Sales Tax | 0% |

| Capital Gains Tax | 0% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | No |

| Non-Resident Withholding Exempt | Yes |

| Tax Treaty Network | No |

| Banking Access | LOW |

| Financial Privacy | HIGH |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | No |

| Banks Restrictive (High Risk) | Yes |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | No |

| Mandatory Audit | No |

| License Required | No |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | No |

| Required Share Capital | $0 |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF recommendations apply |

| Business Plan Required | Basic business plan required for KYC/AML purposes with registered agent |

| Personnel Required | No specific personnel requirements; KYC documentation for directors and beneficial owners required |

| Insurance Required | No |

| Remote Incorporation Possible | Yes |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | Director and shareholder information confidential with registered agent |

| Renewal Period | Annual |

| Accounting Filing Required | No |

| Financial Statement Required | No |

| Accounting Audit Mandatory | No |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | No specific crypto regulator; Marshall Islands Digital Currency Act provides framework; DAO Act 2022 provides legal recognition for DAOs |

| Licensing Fee | $0 |

| Licensing Fee Details | No specific crypto licensing fee. Standard IBC incorporation approximately $880 plus annual maintenance $750 |

| Permitted Business Models | Crypto exchanges, custodial wallets, token issuance, DAO operations, DeFi protocols |

| Permitted Activities | Trading, custody, token issuance, staking, DeFi, DAO governance |

| Restricted Activities | Soliciting Marshall Islands residents prohibited; banking and insurance activities require specific licenses |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | No |

| Derivatives Allowed | Yes |

| RWA Tokenization Allowed | Yes |

| App Store Listing Allowed | Yes |

| Crypto Custody Allowed | Yes |

All gambling activities prohibited including casinos, sports betting, online gambling. Only exception: nonprofit organizations may conduct certain fundraising activities (bingo, raffles, cakewalks)

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | No |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant |

| Business Plan Required | Required for license application |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | No |

| Shareholder/Director Same Person | No |

| Registry Public | No |

| Renewal Period | N/A |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | Office of the Banking Commissioner (Banking Act 1987). Note: Non-resident domestic entities are prohibited from engaging in banking, insurance, and trust services under the Associations Law. |

| Licensing Fee Details | Banking and financial services are generally prohibited for offshore/non-resident entities. Limited domestic banking sector exists primarily for local operations. |

| Restricted Activities | Banking, insurance, trust services, fund management are prohibited for non-resident domestic entities under the Marshall Islands Associations Law |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | No |