Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

Premier asset protection trust jurisdiction

Region

OCEANIA

Corporate Tax

20%

Setup Time

2 weeks

Currency

NZD

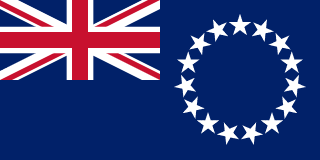

The Cook Islands, a self-governing territory in free association with New Zealand, has developed specialized asset protection trust legislation. The jurisdiction's company registration framework supports specific business setup strategies, particularly for wealth preservation.

With a population of 17,000 across 15 islands, the Cook Islands offer remote Pacific living. English and Cook Islands Māori are official languages. Rarotonga, the main island, provides basic amenities with a small-community atmosphere.

Healthcare is limited, with serious cases requiring evacuation to New Zealand. The tropical climate is pleasant but cyclone risk exists. Safety is excellent with minimal crime. The cost of living is moderate but import-dependent.

The lifestyle suits those seeking genuine island living far from urban centers.

International companies pay no tax on foreign-sourced income. There is no capital gains tax, inheritance tax, or wealth tax. The tax-neutral status and specialized trust legislation attract asset protection planning.

The New Zealand dollar is the official currency. The Financial Supervisory Commission provides regulatory oversight. The jurisdiction maintains appropriate international standards while preserving privacy for legitimate structures.

Company registration through the Registrar of International and Foreign Companies is straightforward. International companies and LLCs serve offshore purposes. Trusts are the jurisdiction's specialty, with legislation specifically designed for asset protection.

Company formation completes within days. No minimum capital requirements apply. Bearer shares are no longer available. Annual requirements include registered agent maintenance and government fees.

The Cook Islands have not developed a specific crypto license framework. Digital asset businesses can incorporate but regulation is minimal. The jurisdiction has not positioned itself for fintech licensing.

No gambling license framework exists in the Cook Islands. The jurisdiction does not offer gaming licensing and has not developed this sector.

Geographic remoteness creates significant logistical challenges. Banking access can be difficult, with correspondent relationships limited. The professional services sector is small.

The Cook Islands suit asset protection trusts, specific holding structures, and clients prioritizing the jurisdiction's unique trust legislation for their business setup.

Local: LLC

Local: International Company

Local: Foundation

Local: Trust

| Corporate Tax Rate | 20% |

| Personal Income Tax Rate | 0-30% |

| VAT / Sales Tax | 12.50% |

| Capital Gains Tax | 0% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | No |

| Non-Resident Withholding Exempt | Yes |

| Tax Treaty Network | No |

| Banking Access | LOW |

| Financial Privacy | VERY HIGH |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | No |

| Banks Restrictive (High Risk) | No |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | No |

| Mandatory Audit | No |

No dedicated crypto licensing framework in Cook Islands. Crypto is not prohibited - VASPs operate in unregulated space. Draft Cryptocurrency Bill 2025 focused on ransomware suppression remains under review and has not been enacted. Cook Islands trusts commonly used for crypto asset protection.

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | No |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | N/A |

| Business Plan Required | Business plan and financial documentation required |

| Personnel Required | Fit and proper requirements for directors and key personnel |

| Insurance Required | No |

| Remote Incorporation Possible | Yes |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | Gaming control records not publicly accessible |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | No |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Ministry of Internal Affairs under Gaming Act 2006 |

| Licensing Fee | $5,000 |

| Licensing Fee Details | Gaming and casino licenses available under Gaming Act 2006 and Casino Regulations 2011. License fees approximately NZD 5,000-50,000 depending on scope. Historically promoted but no longer actively issuing new licenses. |

| Permitted Business Models | Casino, Gaming Machines, Online Gaming (historical) |

| Permitted Activities | Casino gaming, gaming machines, lottery operations - historically licensed |

| Restricted Activities | New gaming licenses no longer actively promoted. Jurisdiction has moved away from gaming industry focus. |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | No |

| Player Fund Segregation | Yes |

| B2B/B2C Separate Requirements | No |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | No |

| Required Share Capital | $1,000,000 |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF recommendations apply; OECD Global Forum member |

| Business Plan Required | Comprehensive business plan with governance structure and operational details required |

| Personnel Required | Directors with fit and proper requirements, compliance officer |

| Insurance Required | No |

| Remote Incorporation Possible | Yes |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | FSC maintains confidential records of licensed entities |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Financial Supervisory Commission (FSC) |

| Licensing Fee | $10,000 |

| Licensing Fee Details | Banking Act 2011 license fees approximately NZD 10,000-50,000. International Companies Act fees separate. Money and Payment Services Policy under consultation as of 2025. Trustee Companies Act governs trust businesses. |

| Permitted Business Models | Offshore Banking, Trustee Companies, International Insurance, Captive Insurance |

| Permitted Activities | Offshore banking services, trust administration (world-renowned asset protection trusts), captive insurance, international insurance |

| Restricted Activities | Domestic banking restricted; services to Cook Islands residents limited for international entities |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | No |